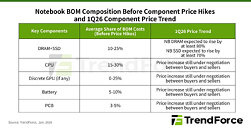

TrendForce observes that CPU accounts for approximately 15-30% of a notebook’s total BOM cost, depending on system configuration. Currently, most entry-level and mainstream notebooks primarily use Intel processors. However, Intel’s recent price hikes for low-end CPUs and continued supply shortages expected to last into March and beyond are putting pressure on product planning and shipping timing.

Contract prices for notebook PC DRAM and SSD in the first quarter of 2026 are expected to significantly exceed previous forecasts, increasing by more than 80% and 70% from the previous quarter, respectively. Additionally, starting in Q4 2025, aggressive shipping efforts by notebook manufacturers led to a rapid decline in memory inventories. Lower fulfillment rates from memory manufacturers in Q1 2026 will limit brands’ ability to source memory, disrupting production and shipping schedules.

TrendForce notes that PCB costs are also rising due to increased design complexity and rising copper prices. Structurally higher PCB costs are expected to be a long-term trend as the number of motherboard layers increases with spec upgrades for mid- to high-end notebooks.

Specification upgrades are increasing the cost per battery unit, and rising prices for lithium battery materials are pushing battery estimates even higher. On the other hand, as the power consumption of CPU and NPU increases, the demand for PMIC increases. The adoption of new standards such as Wi-Fi 7 and USB4 has also increased the cost of associated chips and connectors. Although the price increases for these components are smaller than the individual price increases for memory and CPU, their combined impact creates a significant financial burden for notebook brands, which typically have low margins.

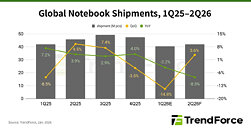

Despite the increased supply-side risks, the brand remains relatively optimistic about its 1Q26 shipment outlook. However, TrendForce predicts that brands may face difficulty securing all necessary components on time, resulting in a 14.8% quarter-over-quarter drop in shipments in the first quarter of 2026. We expect a gradual quarter-over-quarter recovery in Q2 2026 as Intel’s CPU supply improves.

TrendForce has revised down its 2026 notebook shipment forecast from a 5.4% year-over-year decline to an even more significant 9.4% decline. The market faces increased near-term uncertainty due to rising memory prices and volatile CPU supply. Going forward, factors such as changes in supply of key components, brand cost adjustments, inventory levels, product strategy and consumer acceptance of higher prices will be critical in shaping the second half of 2026.